Review & Outlook

July 14, 2021

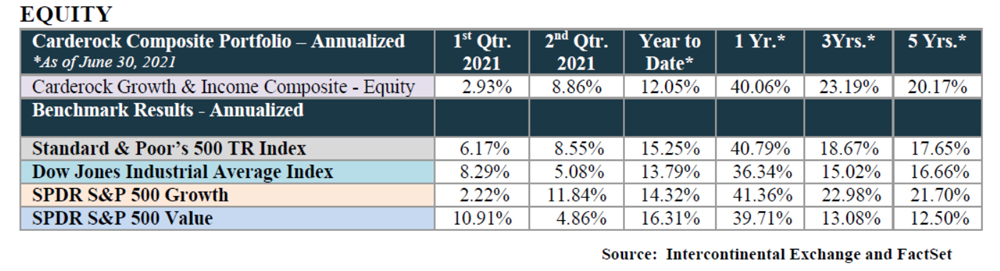

During the period we were pleased to see the stock market refocus on Growth issues that gave a boost to Carderock holdings for the period. This was a meaningful turnaround from the 1st Quarter where Value companies were favored. While page 2 of the Carderock statement “attached” shows your individual performance, below summarizes the results of our firm’s Composite Portfolio.

Currently our primary concern is less about “Growth vs. Value” styles and its performance as it is on managing your equity exposure as valuations climb together with volatility. During the next six to twelve months, we see the following themes capturing the market’s attention and driving our investment decisions:

- Supply constraints – Low inventories, overburdened shipping, and idled production have failed to keep pace with surging demand – deferring many sales into 2022.

- Labor and Production – Improving in the US, but many other countries are behind expectations and prone to lower growth (e.g., Japan).

- Delta Variant – Looks to further burden the Global economy.

- Federal Reserve – Shifting away from accommodation (raising interest rates, reduces bond purchasing and raises reserves).

- Infrastructure Legislation – (If passed), would ramp growth higher pushing economic progress into 2022 and 2023.

- Inflation – Cool and temporary if the Federal Reserve gets its way or hot and sustained if not (Stagflation).

Stocks – During the quarter, we sold shares taking profits in most cases and cutting back on a few laggards. Proceeds were rotated to a few new positions that we believe have better prospects while at the same time managing your cash reserves to the appropriate levels. We anticipate similar actions during the 2nd half of this year, balancing industry exposure and keeping asset allocations within range.

If the market’s positive momentum continues, realized capital gains may reach or exceed your budget. Therefore, please keep this in mind and inform us should this be of concern. In addition, we raised our Equity Cash Allocation Target to 16% and may go higher if the economic data warrants. For now, we are following the flow of corporate earnings, employment, inflation, and Fiscal Policy before making any decisions on reserves.

Bonds –The challenge with maturities occurring more frequently lies in reinvesting in more favorable conditions. We expected to have seen higher rates by now but that has not materialized. While we did add a few new issues during the quarter, our activity was modest and thereby, bond cash balances have crept higher. Until we have “lift off” from the Zero Interest Rate environment that has prevailed since 2008-2009, we do not want to lower quality in our future bond purchases in order to reach for higher yield as what we see as an ending of a credit cycle.

Finally, included in this Report, you will find our latest filed copy with the Securities and Exchange Commission of our Form CRS and Form ADV for your review. Dan Kane has assumed the duties of Chief Compliance Officer at Carderock Capital Management. In this role, he will oversee Carderock’s continued commitment to excellence in regulatory compliance that Skip Mersereau has skillfully and exceptionally stewarded the firm over the past 15 years. We have amended our Forms ADV and CRS to reflect this change. You can access the updated forms on our website, www.carderockcapital.com or through www.investor.gov.

As always, we invite your calls to inquire further regarding your portfolio or to discuss changes in objectives, circumstances, and their impact.

Warmest Regards,

James W. Mersereau, CFA, CIC

President

Daniel A. Kane, CFA, CIC

Managing Director